Two reports came out this week on climate change, neither of which drew much public notice outside the investing world. One, by Mercer consulting, managed to generate a little bit of news with its warning that climate change poses significant risks to investment portfolios over the next 20 years. I wouldn’t be at all surprised to see this come up in hearings or ad campaigns. Environmentalists have had little luck with politicians who turn their willfully blind eye to the health and environmental risks that climate change poses. Perhaps they’ll have more success convincing them that the financial risks make it worth addressing. I wish them luck.

The other report, from Deutsche Bank Climate Change Advisors made even less of a splash, but it should be on everyone’s reading list.

I’m on record as not being overly sympathetic to the economic plight of Wall Street when it comes to climate and energy. Efficient and effective climate policy will have to make polluting less profitable. There is no way around it. Vested interests have had decades to adjust to the scientific reality of climate change and to the possibility of climate policy changing the fundamentals of the energy industry. If you happen to be among the wealthiest companies on the planet and you haven’t diversified away from climate polluting industries despite having nearly a generation to do it, you’ll have to forgive me if I fail to shed a tear. The concept of regulatory risk has is not novel. Smart businesses learn how to hedge against it.

Economics remains the fundamental argument around climate policy: If we pass a law to reduce climate pollution, how can we guarantee that the economy stays healthy and creates enough jobs? That’s why the environmental movement has put so much focus on the idea of “green jobs.”

There is what I consider to be a shockingly simple proposition that, even in this environment gets far less attention than it deserves: If you’re concerned about employment, talk to employers. Or at least listen to them. Or the people that help fund them. They’ll tell you exactly what they need.

Deutsche Bank calls it TLC. Transparency, Longevity, and Certainty and consistency. (Yes, I know there’s an extra C in there. Work with me.). If climate and energy policy can provide these three things, i.e. if it’s open and transparent, matches an appropriate investment horizon, an sets up an incentive structure that they can count on, investors can make money off of climate policy.

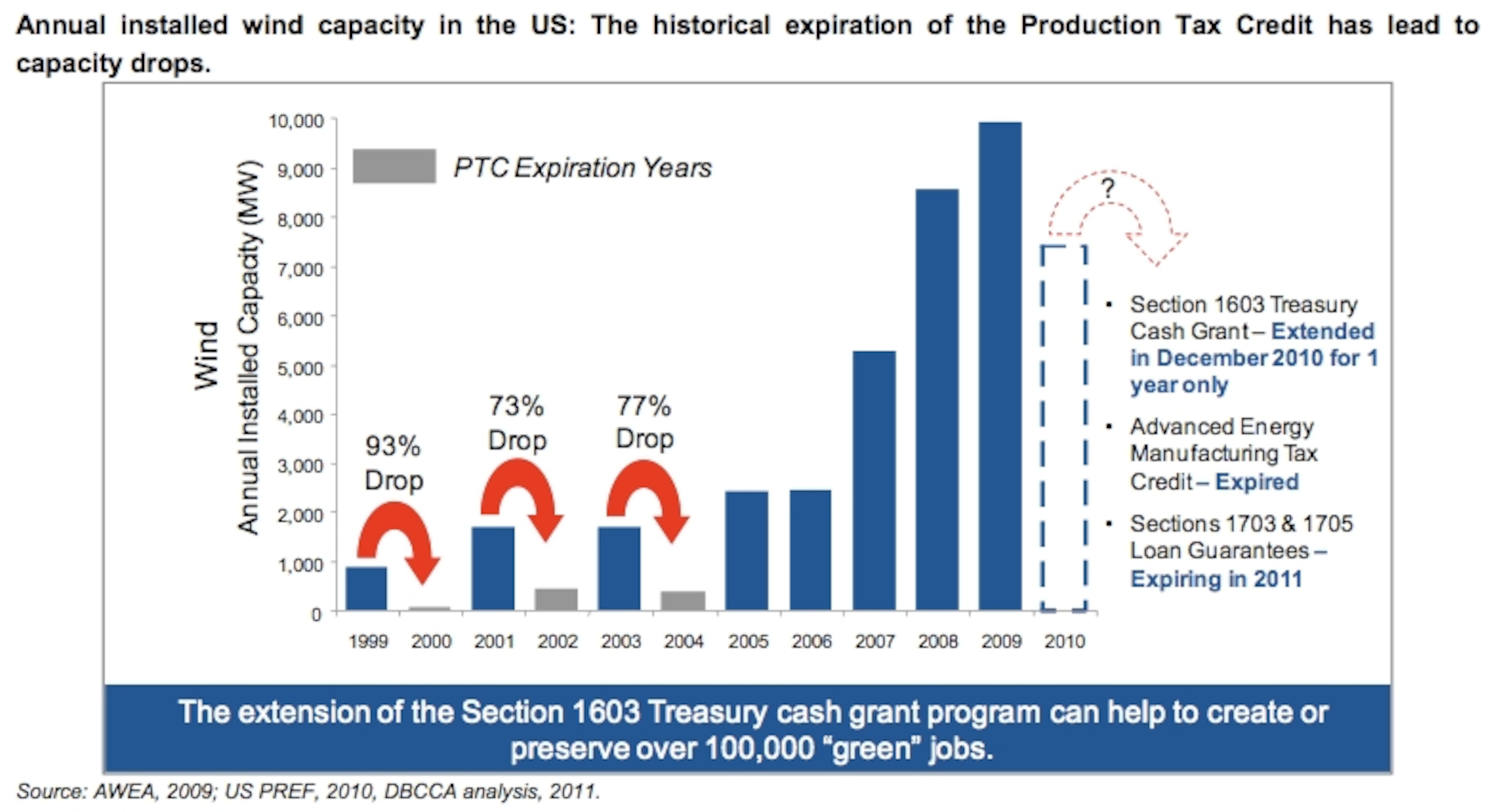

Notably missing from this list is perfection. Markets and investments don’t need a perfect climate policy, they just need one they can work with. The Deutsche Bank report has two graphs in it that should serve as a warning.

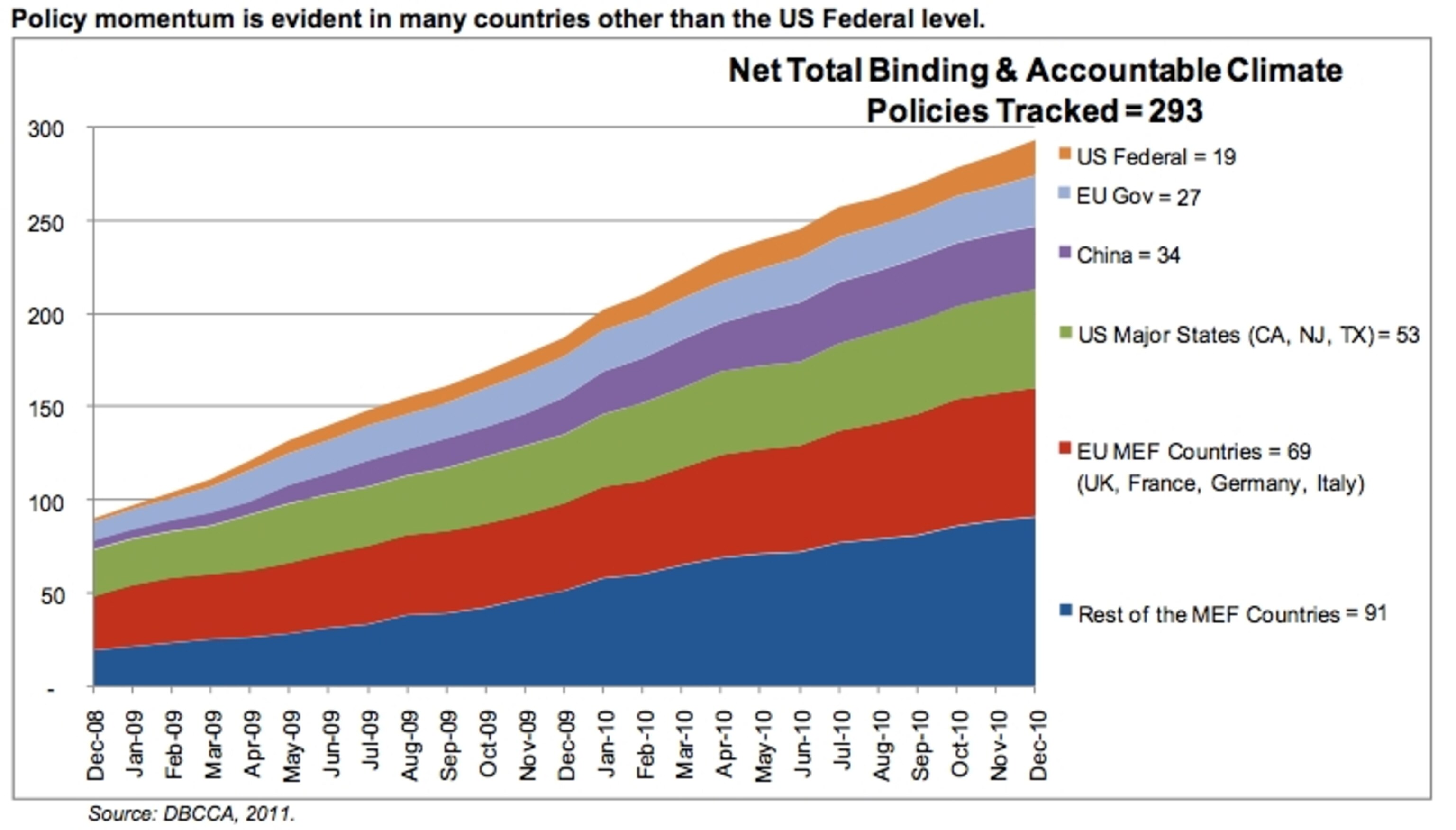

First: What governments are providing the kind of policy environment they need? (Hint: Not the U.S.)

Second: What happens without it? (Hint: It’s not good)

Thankfully, the report highlights some U.S. States, like California, New Jersey, and Texas (yes, Texas) where the policy environment is helping drive investment and job growth in renewable energy and other climate-related industries. But let’s be honest, outside of California, there isn’t really a lot of hope.

I often hear people complain that economics is hard (I used to hear it a lot more when I taught it), but I don’t think it gets any easier than this. We want to know whether we can continue to create jobs under climate policy, and investors are telling us how. They are ready to make money off of climate policy. What they can’t make money off of is the uncertainty and the political hemming and hawing.

They need policy that they can understand, count on, and plan against. If we can’t give them that, they’ll go out and find someone who can. The nature of the financial economy is that investment dollars will flow to wherever investors see the best opportunity, and right now, that’s not the U.S.

That is the climate policy we should be worrying about.