Renewable Energy: Ontario’s New Gold Rush

Ontario is better known for majestic falls and forests than for its sun, but a one-year-old government incentive program has made the province a solar energy hotbed.

This story is part of a special series that explores energy issues. For more, visit The Great Energy Challenge.

Tourists typically come to Ontario to gaze at the majesty of Niagara Falls or to breathe the fresh air of the boreal forest of the Northwest, not to bask in the sun. But Canadian sunshine grows grass tall enough to feed Bryan Gilvesey's cattle, Texas Longhorns that he raises on a ranch he's converting entirely to alternative energy.

"It struck me that we're really harvesting energy from the sun on these prairies," Gilvesey says. "It seems that solar's a natural for us farmers."

(Related: National Geographic Travel & Cultures: Ontario)

Thousands of Ontario farmers agree. They're at the vanguard of a new gold rush—a race this time to capture the sun's golden rays. They have jumped into solar energy over the past year, spurred by a government effort—unlike anything on the continent—to encourage renewable energy.

Since October 2009, Ontario's government has agreed to buy energy from renewable sources at a price that all but guarantees a profit. Some installers have claimed small projects could get hefty returns of 20 percent or more, paying back costs in about five years with pure annual profits of at least $4,000 (Canadian) for the rest of a 20-year contract. In a flash, the province became a North American hotbed for investment in renewable energy, second only to California.

More than 23,000 applications for the renewable energy program have flooded government offices. The "feed-in tariffs," or contracts for buying renewable energy, arose from a broad program launched by a Liberal Party government elected in 2003. The Green Energy Act of 2009 launched a shift from coal-fired generation so swift that even environmentalists sound surprised.

"I call it the most progressive renewable energy policy in North America in three decades," says Paul Gipe, who's written several books about wind energy and helped lobby for the bill. He compared it to the U.S. National Energy Act enacted in the depths of the 1970s oil crisis.

Out of the Darkness

Ontario saw its own depths with growing brownouts and fears of widespread disruptions.

Ontarians were rattled by the Northeast blackout of 2003—which left 50 million people across Ontario and the Northeast United States without power for up to two days and cost an estimated $6 billion. The August debacle helped the Liberals win the election two months later. "We were barely able to keep the lights on," Ontario Premier Dalton McGuinty recently told legislators.

Rather than building more conventional power plants, McGuinty's party promised a green-energy effort that would shutter all of Ontario's coal- and oil-fired plants, which in recent years had provided nearly a third of the province’s electricity, and are big contributors to greenhouse gases and other harmful pollution.

The government modeled its effort on Germany and other European countries whose guarantees to buy power helped stimulate renewable energy projects.

(Related: “Frozen Fish Help Reel in Germany’s Wind Power”)

Already, the popularity of the renewable energy program means Ontario can meet its goal of cutting out coal in 2014, but some would like to do more, says Ben Chin, a vice president at Ontario Power Authority, the government agency managing the power conversion.

"Now the debate is about shutting down coal sooner," he says.

Ontario's quest to go coal-free would mean that nuclear power would continue to provide about half of the province's electricity. The other major source would be the hydroelectric power that Ontario has generated for a century at Niagara Falls, with natural gas and renewables providing the rest.

The renewable energy effort comes under criticism because of its expense. The rate offered for some solar power runs 20 times that paid for nuclear or hydro power. Those highest rates are for small projects, the so-called MicroFIT (for Micro Feed-In Tariff) projects targeted at homes, schools and farms. They make up the bulk of those 23,000 applications but remain only a small sliver of the expected power production. Much more electricity will come from larger projects, particularly from wind.

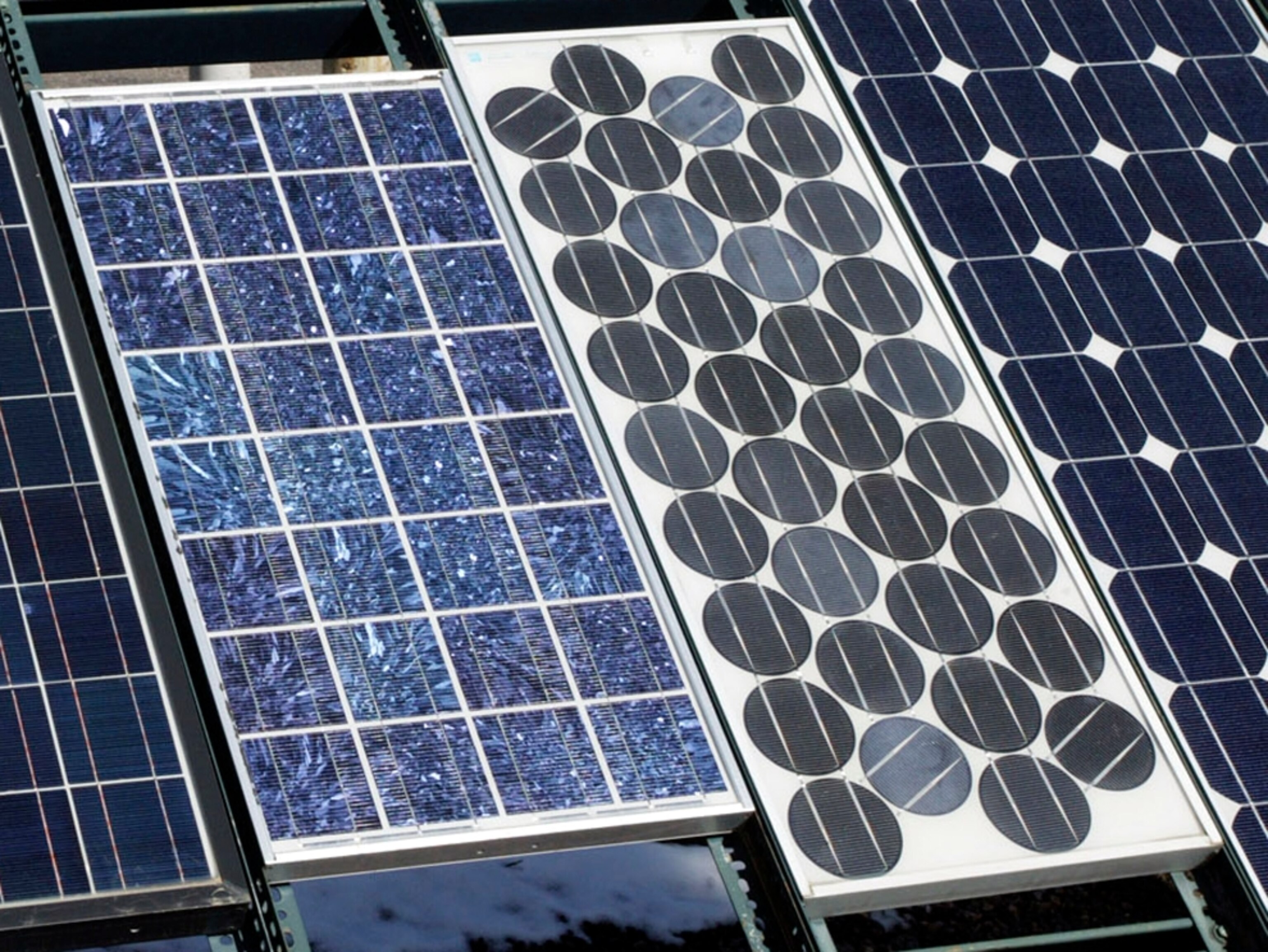

Still, the rates paid for power from large solar projects also appear steep next to conventional sources. That's partly technology—the expense of solar panels, for one, often makes it tough for them to compete with conventional energy sources. It's also partly geography. The minimal sunlight in Ontario means it takes longer to produce energy to sell to the grid. That reduces profits, and Ontario must subsidize rates more to encourage investment. Even the southern stretches of Ontario get considerably less sunshine than other centers of solar investment—about a third less, say, than Nevada, according to the U.S. National Renewable Energy Laboratory (NREL).

(See NREL’s solar potential calculator.)

The money will largely come from ratepayers, already suffering from double-digit hikes in electricity costs. Backers say the spending will not only generate clean energy, but also a green industry with 50,000 workers. The province hopes to replace jobs lost to the troubled auto industry and other manufacturing.

An Attempt to Buy Local

Ontario will require that feed-in-tariff projects use equipment mostly built in the province. More than a dozen European and American equipment makers have responded with plans to build plants in the province.

Ontario is also working to slow the work of foreign installers who flooded the market, says Omer Mir, a top executive at Toronto-based Grasshopper Energy, a local newcomer to solar energy.

Veteran companies around the globe watch for new feed-in-tariff programs to emerge. "As soon as one comes in, they're the first to get there," he says. "Canadians are still slow coming."

Critics say the popularity of the feed-in tariffs proves Ontario overpaid for its renewable energy, which includes large wind, biomass and geothermal projects. Ontario Power Authority tries to design rates to give investors roughly an 11 percent return, but it's a tricky business that depends on the cost of solar panels, installation and how much sun is available.

(Related: “Solar Power”)

Ontario recently adjusted the program, tightening standards and cutting rates it would pay to some solar generators. The ground-based panels particularly targeted by the cuts proved popular with farmers. Ground-based systems can be outfitted with technology that allows them to move throughout the day to maximize sun exposure and energy. While they can cost more to install, they also produce more energy and the government concluded they were being oversubsidized.

Applications from Gilvesey and other early adopters will still get the old rate, though, and he has ground-based panels in mind for his organic ranch in southern Ontario, about a 30-minute drive north of Lake Erie. He wants them mounted on poles, however, partly because he fears thieves. "What better way to protect your panels than to have a Longhorn bull beneath them?" he asks.

It also would make a pretty picture, the rancher adds: "Sustainable food being grown right under solar panels."