Clean Energy: The Future is Here

Harnessing the energy of the sun—along with the power of wind, water and the earth’s heat—has become a reality.

Nearly a century ago, Thomas Edison imagined tapping the inexhaustible power of the sun. Today, harnessing that energy—along with the power of wind, water and the earth’s heat—has become a reality. Technological and financial innovations have brought renewables into the mainstream, and the resulting transformation will lead to energy savings, reduced carbon emissions and greater energy diversification.

Safe, Clean, Inexhaustible: 5 Types of Clean Energy

"Clean energy" can refer to a range of technologies. Here are five that tap into power that’s virtually inexhaustible:

I'd put my money on the sun and solar energy. What a source of power! I hope we don’t have to wait until oil and coal run out before we tackle that.Thomas Edison, 1931, Source: Uncommon Friends: Life with Thomas Edison, Henry Ford, Harvey Firestone, Alexis Carrel, and Charles Lindbergh, by James Newton

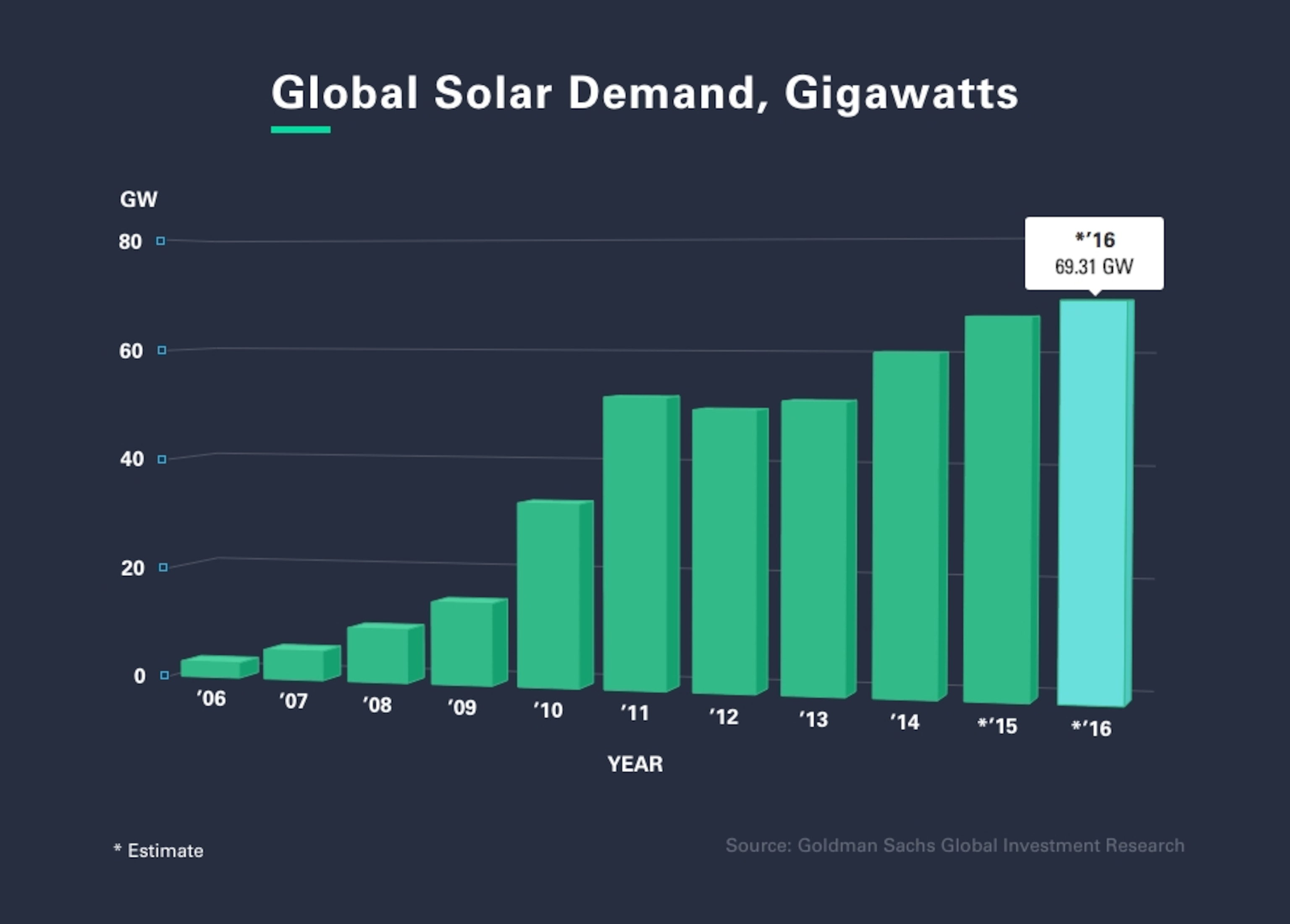

The Solar Boom

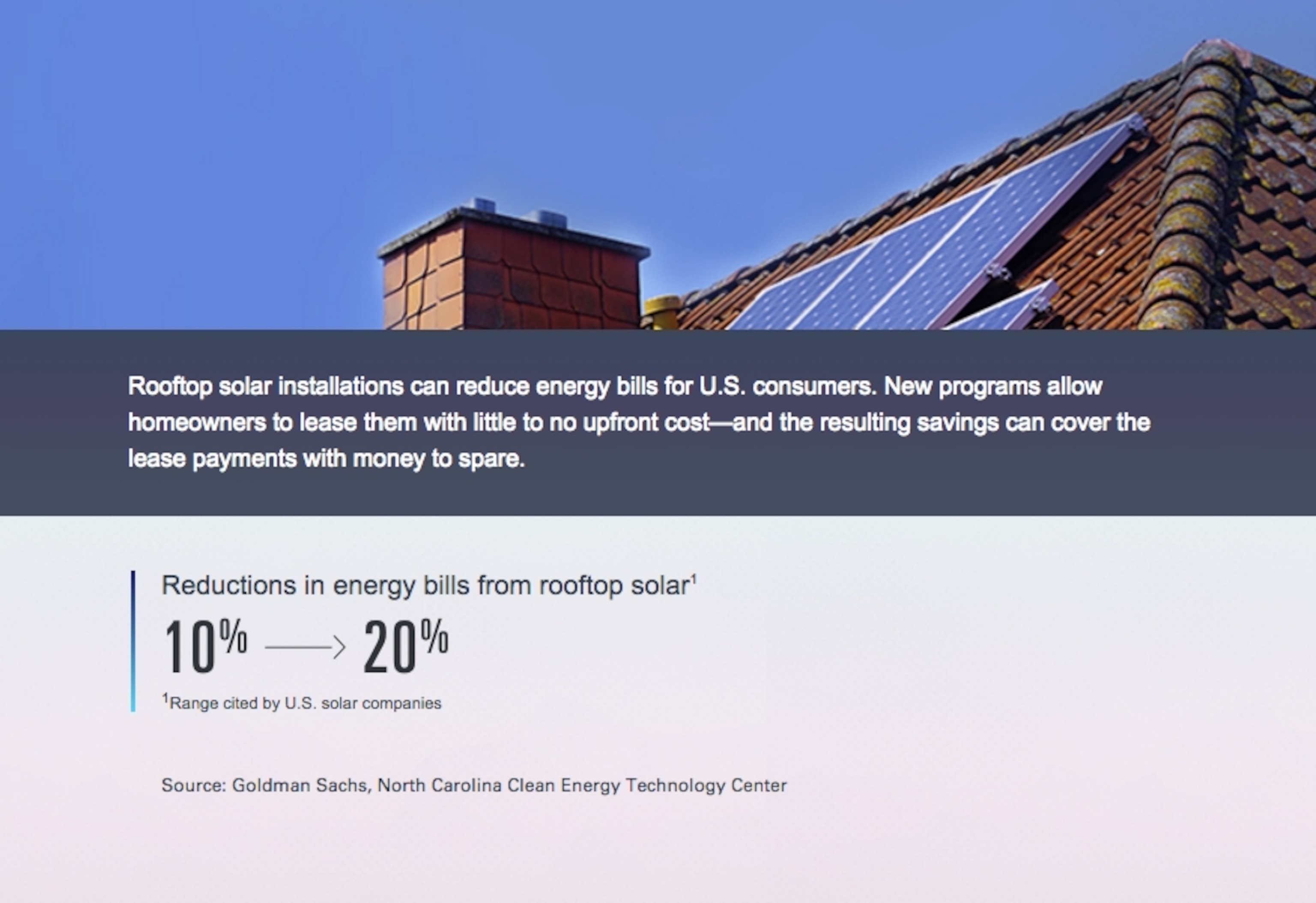

Solar power—in particular, rooftop solar—is expected to continue its already rapid growth in the next few years.

(Energy conservation - It starts at home)

Inside the Home of the Future

The switch to renewables is just one way that the world’s energy usage is changing. Smarter, internet-connected devices are giving consumers the ability to track their power consumption and control lights and appliances. Here’s how today’s technologies will come together in the house of tomorrow:

Financing the Future

It takes great ideas to move an industry forward. But it takes capital to bring a great idea from the whiteboard to reality. Here are some of the key steps along the way:

Startup— In this early phase, governments, venture capital and other investments fund early development, prototyping and initial production. These can be risky for the investors, but capital at this phase is crucial for getting successful ideas off the ground.

Initial Access to Capital Markets— If the early work is successful and the technology is proven and commercialized, the company usually launches an initial public offering (IPO) of stock or issue bonds. With access to capital markets, the company can scale up operations or expand its production facilities to reach more customers. Once the business has entered the markets, it becomes easier and more efficient to connect with investors and raise capital.

Capital Market Innovations— In recent years, new financing structures have provided the clean energy industry with greater capital access to grow and deploy renewable technologies at scale. Here are two examples—one raising money by issuing equity (i.e., stock), and another using debt (i.e., bonds).

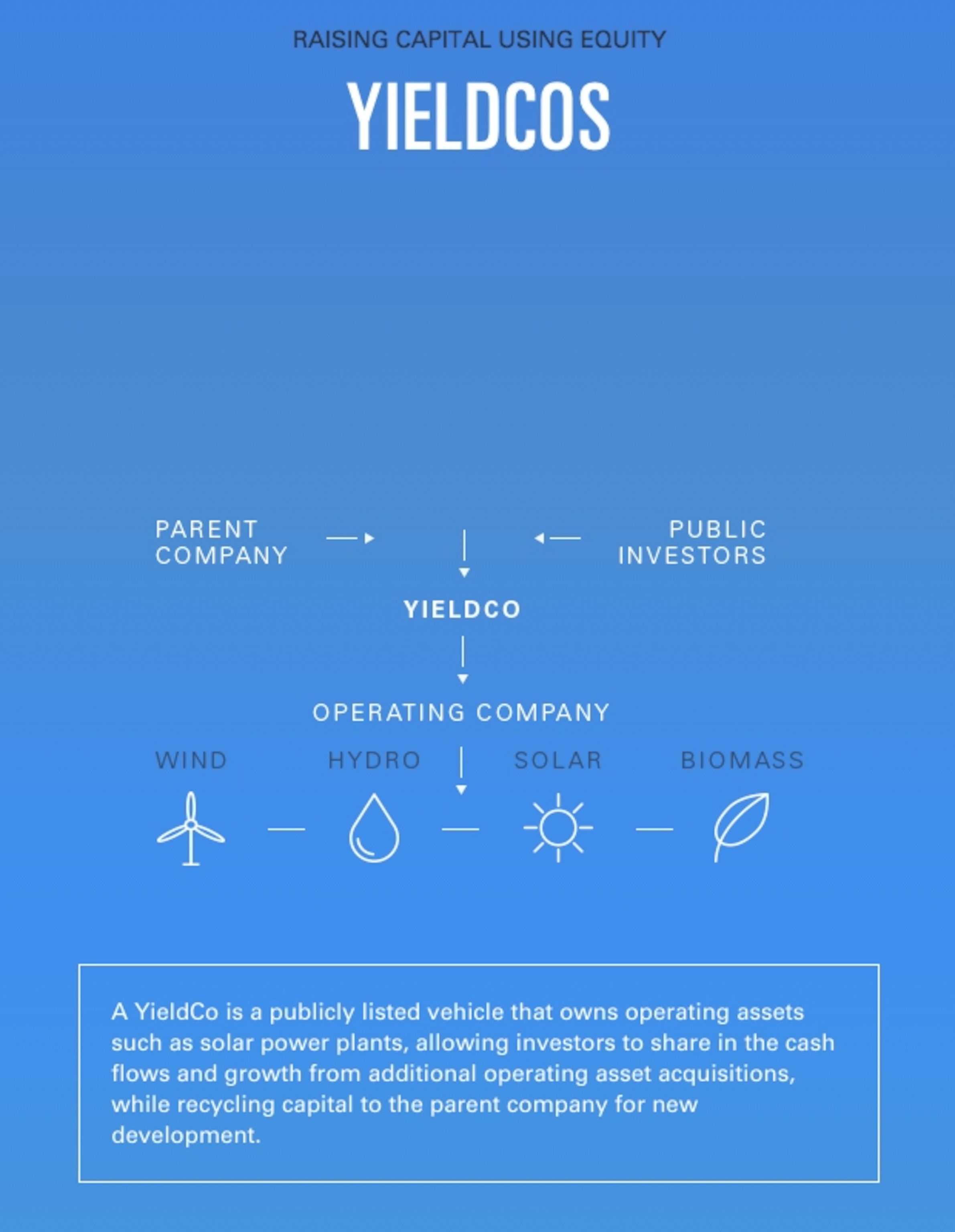

Raising Capital Using Equity: YieldCos

The Challenge: Investors Put a Price on Risk—High-growth clean energy companies carry business risks. These include the need to fund project developments that require large amounts of upfront capital with returns spread over a long period of operation—building renewable power plants, for example. This risk drives investors to seek greater returns, which can lead to a higher cost of capital.

The Opportunity: Separate the Risk, Share the Growth—Once clean energy plants are built, they generally offer stable, reliable, long-term cash flows. A YieldCo gives investors a chance to participate in that cash flow stability through a dividend (or "yield") while avoiding the associated development risks.

In addition, YieldCos often have a pipeline of future assets to acquire from the Parent Company or third party developers, allowing investors to realize cash flow growth in addition to yield. For clean energy developers (e.g. a Parent Company), aggregating operating assets and selling them through the YieldCo provides a mechanism through which it can free up capital that can be used to fund additional clean energy growth and development.

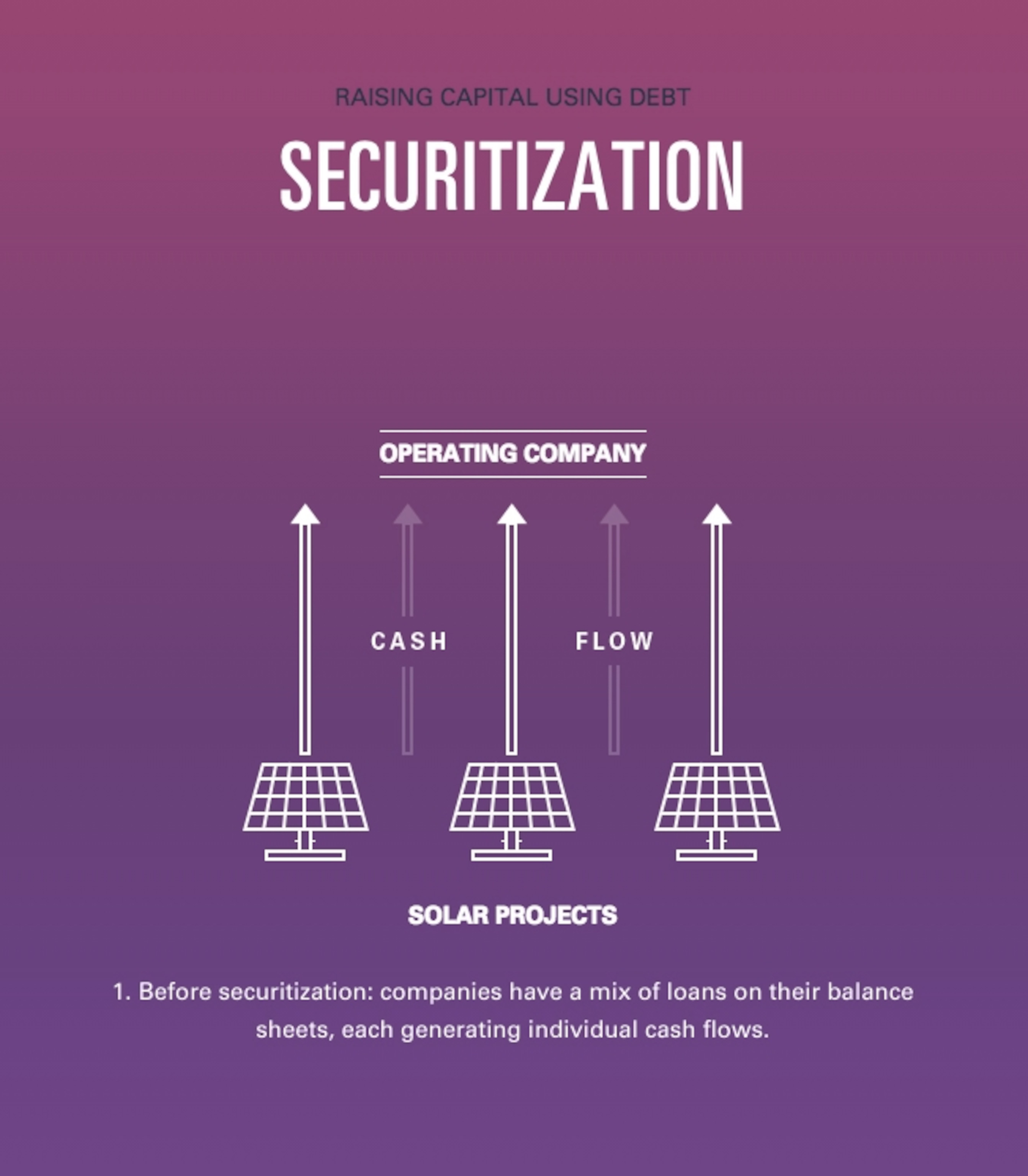

Raising Capital Using Debt: Securitization

The Challenge: Smaller Assets, Limited Liquidity—Clean energy companies often own many smaller-scale assets—rooftop solar leases, for example—which generate stable cash flow over time, but may not provide upfront liquidity.

The Opportunity: Aggregation, Diversification, Liquidity—Securitization allows companies to aggregate expected cash flows from those smaller-scale assets into larger, diversified bundles. “Slices” of these securitizations are then structured as bond tranches and sold to investors, who receive a portion of the cash flows over time. The companies get upfront capital that they can reinvest in growth, while still maintaining a residual ownership interest in their projects.

The Takeaway: A Smarter Future

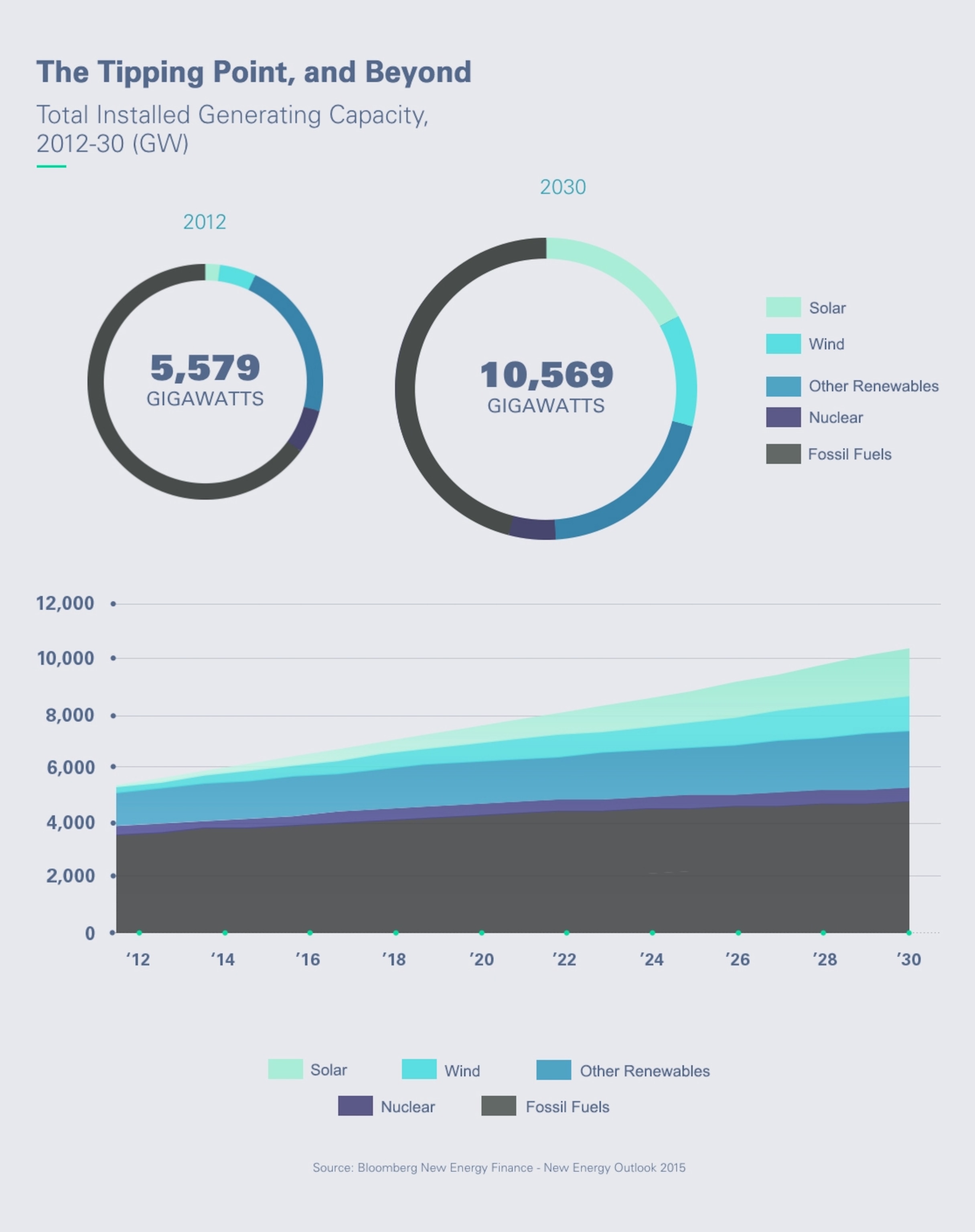

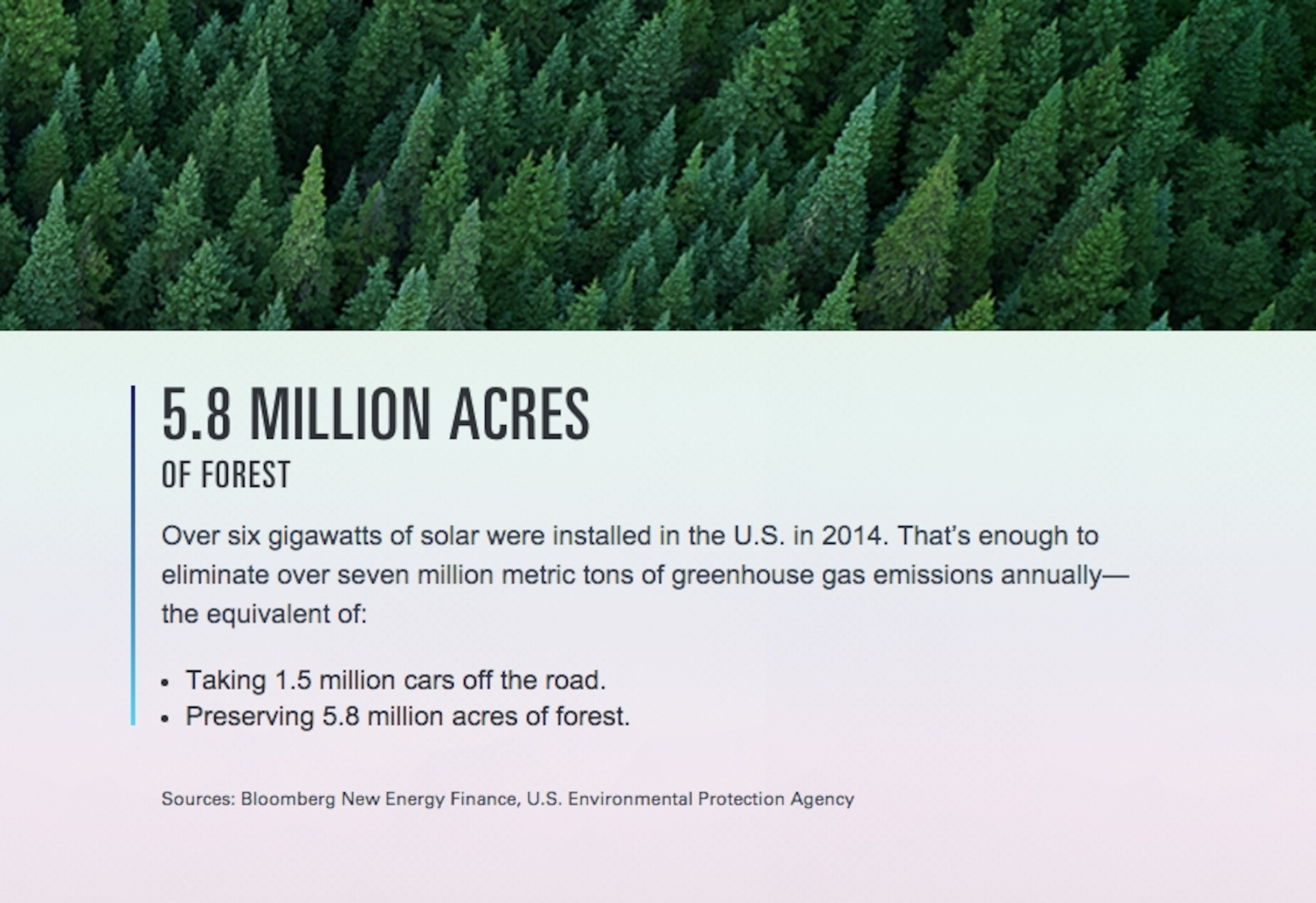

Technological innovations and new financing methods are making renewable energy more accessible than ever before. As a result, solar, wind, hydropower and other sustainable sources are expected to account for half of our global energy mix by 2030, according to estimates from Bloomberg New Energy Finance.

This transformation will allow the world to meet its growing power needs more sustainably—helping to create a cleaner, healthier and brighter future.