Battery Maker A123's Bankruptcy Underscores U.S. Hurdles for Clean Tech

The bankruptcy filing this week of U.S. government-backed battery maker A123 Systems demonstrates the challenges of developing clean energy technology in a still-evolving market.

The deep divisions over energy in the United States punctuated Tuesday night's presidential debate. But an event several hours earlier—the bankruptcy filing of lithium ion battery maker A123 Systems—makes clear the complexity of the task that will face any president in the race to develop the forward-looking technology for future transportation.

A123, which had been backed by nearly $256 million in public funds awarded under the Bush and Obama administrations, said Tuesday that Milwaukee-based battery giant Johnson Controls plans to buy the company's automotive business. (See related blog post: "A123's Bankruptcy by the Numbers")

A123 has developed energy storage technology for the electric grid as well as for electric cars and commercial applications. The Johnson Controls deal, which is valued at $125 million, includes two plants built in Michigan using grant money from the U.S. Department of Energy. It will also provide $72.5 million in financing to continue A123's automotive operations. Discussions are continuing for "strategic alternatives," A123 says, for the other segments of its business. A123 stock plummeted 18 cents to 6 cents a share on Tuesday—a dramatic decline from its all-time high of more than $22 per share in December 2009, just a few months after the company's initial public offering.

This past August, A123 had announced that Chinese auto-parts maker Wanxiang Group would invest $450 million in the company, providing a much-needed infusion of cash. But the investment did not go forward "as a result of unanticipated and significant challenges to its completion," A123 CEO David Vieau said in a statement. (See "Snapshot: Chinese Investment in North American Energy in 2012") But the president of Wanxiang's U.S. operations reportedly said Wednesday that it is still interested in acquiring A123, and that the bankruptcy filing could clear away some legal hurdles.

"In an emerging industry, it's very common to see some firms consolidate with others as the industry grows and matures," DOE public affairs director Dan Leistikow said in a statement Tuesday about A123's bankruptcy and the deal with Johnson Controls—another DOE grant recipient. "Today's news means that A123's manufacturing facilities and technology will continue to be a vital part of America's advanced battery industry."

Yet the company's trajectory follows an increasingly common arc, says Steve Minnihan, an analyst with the market research firm Lux Research: "A North American startup developing technologies in an energy storage space, only to lose out to Chinese and Japanese competitors," and in some cases, end up moving overseas. The situation mirrors what happened with energy storage startups like Boston-Power, as well as in the solar industry, he said.

In some respects, A123 had the technology, but lacked the necessary length of runway for success. A123 is "by far the largest lithium-ion battery supplier to the utility sector. They are seen as the gold standard for technology in the grid space." Minnihan said. "But even at the end of 2012, potential utility customers do not understand the value proposition of lithium ion batteries, and they don't have an urgent need for this technology." Generally conservative and slow-moving utilities would want to see lower costs and at least two or three more years of data showing how A123's systems perform in the field before getting on board, he said.

Nonetheless, A123 has made significant headway in the utility sector, where its technology can store energy from wind and solar farms to make renewables available around the clock. "They've done a lot of the difficult work trying to till the soil in the utility space. That is their single largest accomplishment," Minnihan said.

And yet A123 is commonly associated with electric cars—more than it should be, Minnihan says, given the small scale of its business in the transportation sector. Among other deals, the company won supply contracts from General Motors for its forthcoming Chevy Spark EV city car, planned for low volume production next year; from Fisker Automotive, a plug-in hybrid vehicle startup backed by the Obama administration that has encountered technical and financial difficulty; from plug-in truck converter Via Motors; and from BMW, for its ActiveHybrid 3 and 5 series. (See gallery: "Eleven Electric Cars Charge Ahead, Amid Obstacles")

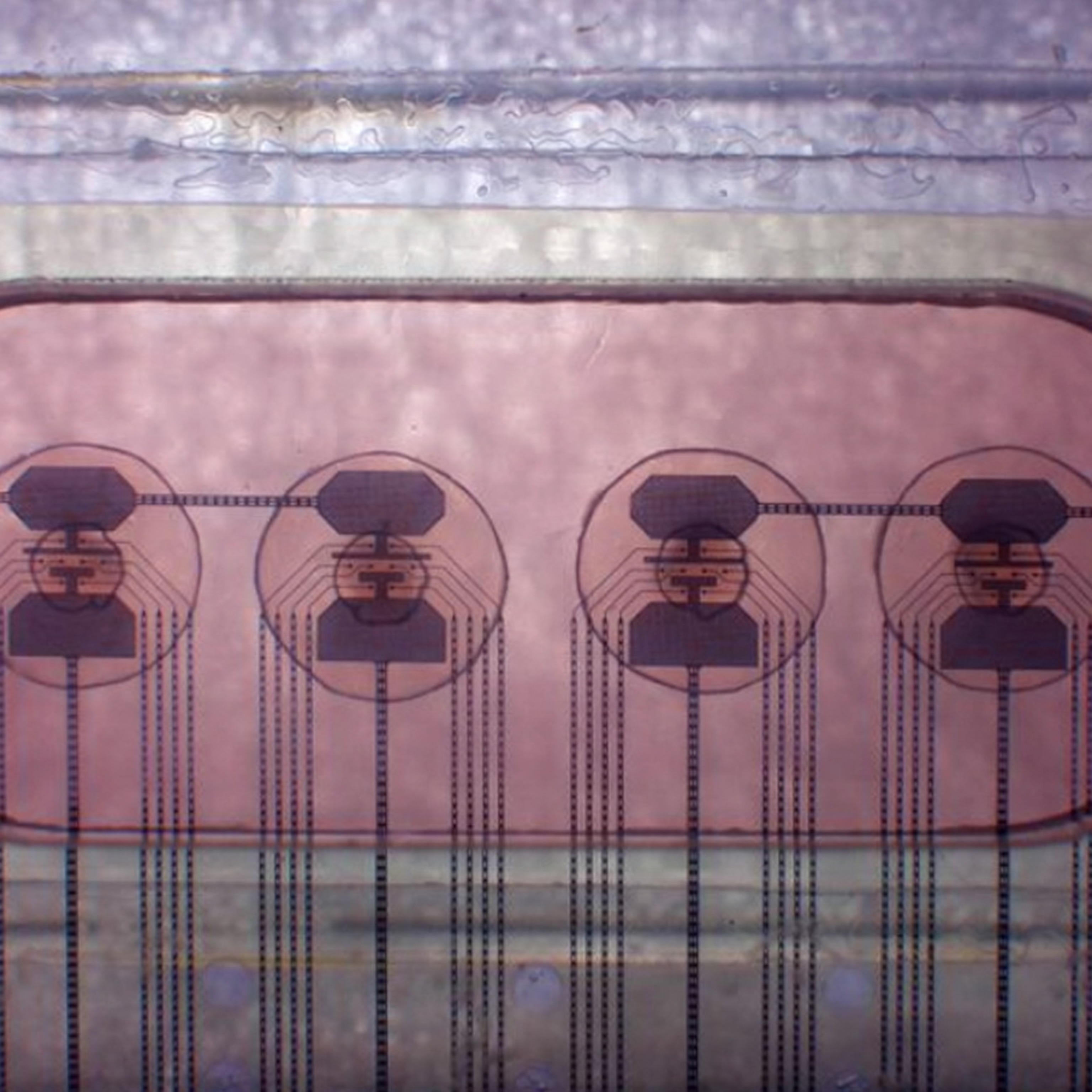

And the company claims to be the world's largest supplier of battery systems for hybrid buses. According to John Gartner, an analyst with Pike Research, part of Navigant Consulting, such deals are "impressive for a startup company when competing with Korean and Japanese companies that had much lengthier experience in manufacturing lithium ion batteries for other markets." (See gallery: "Seven Ingredients for Better Electric Car Batteries")

Cultivating a domestic battery supplier capable of competing head to head with overseas giants was part of the idea behind the government grants awarded to A123. According to the White House transcript of a call placed to congratulate A123 Systems for opening a manufacturing facility in September 2010, President Obama said, "When folks lift up their hoods on the cars of the future, I want them to see engines and batteries that are stamped: Made in America. And that's what you guys are helping to make happen."

So far, however, the market for those cars of the future remains planted in the lackluster present. Since 2011, just 50,000 electric vehicles have been sold in the United States—about 5 percent of President Obama's goal of getting 1 million EVs on U.S. roads by 2015.

A123 has come up short in short in the race to win many of the biggest contracts in this still-emerging market. "If we look back 10 years from now and the lithium-ion market is booming, A123 is not going to be the hero that brought about that market," Minnihan said. "They're just one of the players." (Related photos: "Rare Look Inside Carmakers' Drive for 55 MPG")

This story is part of a special series that explores energy issues. For more, visit The Great Energy Challenge.

Correction: In a previous version of this story, the caption erroneously stated that the Obama administration's grant to A123 occurred in 2008. This date has been corrected to 2009.